Episode 359

Jun 11, 2021

Michael and Allissa take the stigma out of "budgeting" and make it a productive and useful tool to relieve stress and give you freedom.

Listen to "E359: Budgeting on the Irregular Income of a Massage Therapist" on Spreaker.

EPISODE 359

Weekly Roundup

Discussion Topic

- Budgeting on the Irregular Income of a Massage Therapist

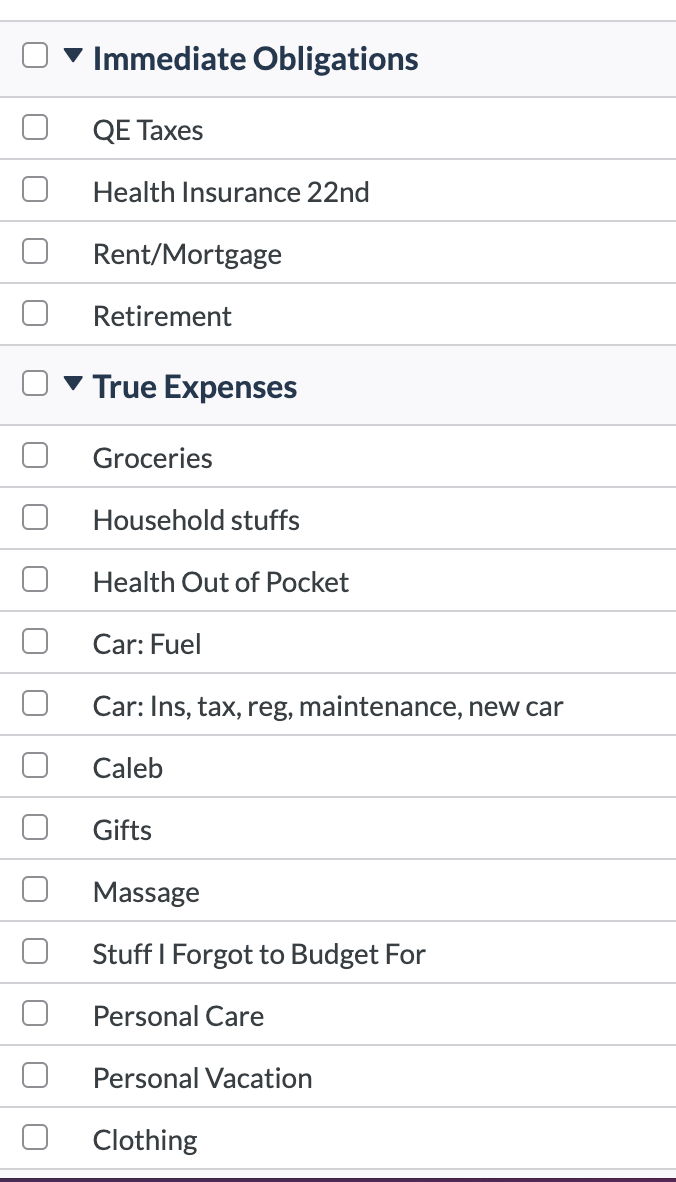

- Screenshot of Allissa’s personal YNAB categories:

Quick Tips

- What’s something you used to do that was helpful but stopped doing? (me: meal prep) Get back to it.

- Simplify and clarify your message

Sponsors

Transcript:

Sponsor message:

This episode is sponsored by The Original Jojoba Company. I firmly believe that massage therapists should only be using the highest quality products because our clients deserve it and our own bodies deserve it. I have been using jojoba for years, and here's why. Jojoba is non-allergenic. I can use it on any client and every client without fear of an allergic reaction. It is also non-comedogenic so it won't clog pores. So if you've got clients prone to acne breakouts, jojoba is a good choice for them. It does not go rancid. There's no triglycerides, so it can sit on your shelf for a year plus and not be a problem, and that's what also makes jojoba a wonderful carrier for your essential oils as well. It won't stain your 100% cotton sheets so your linens are going to last longer. The Original Jojoba Company is the only company in the world that carries 100% pure, first-press quality jojoba and we are delighted to be their partner. You, my friends, can get 20% off the price of the product when you shop through our link, massagebusinessblueprint.com/jojoba.

Allissa Haines:

Hello, everyone. Welcome to the Massage Business Blueprint Podcast where we help you attract more clients, make more money, and improve your quality of life. I am Allissa Haines.

Michael Reynolds:

And I'm Michael Reynolds.

Allissa Haines:

And we are your hosts and we are delighted that you are here today. Michael, do you have a review for us to talk about and tell people about our deal?

Michael Reynolds:

You caught me. I was just opening that tab right as I looked at the agenda and realized that we were doing this. I may or may not.

Allissa Haines:

I'm going to give Michael a little bit of time to look.

Michael Reynolds:

I do. I have one.

Allissa Haines:

Yay, yay. So the deal here is that if you are so kind as to leave us a review on Apple Podcasts, we are going to pick a review every week, read it on the air, and then offer that reviewer a half an hour business consultation time with Michael and I and we have done one already, which was really fun. And we want to do more. So Michael, what do you got for us?

Michael Reynolds:

Yeah, so this is a recent review from the end of last month from Sage Healing LMT and Sage Healing LMT gave us five stars. We appreciate that. And the review states, "So much awesome info. I am a frazzled new business owner who is lucky enough to stumble upon this podcast after watching the ABMP website webinar. I'm so grateful that this podcast is available. It has been a breath of fresh air to help someone else besides me talking about the perils of owning your own massage business. I'm joining your premium member community ASAP and wanted to thank you." So this person joined our community on top of it all. So, I am thrilled to hear that.

Allissa Haines:

Ah, that's great. [crosstalk 00:02:55].

Michael Reynolds:

So thank you for that. The user name is Sage Healing LMT. So if that is you listening please send us an email at podcast@massagebusinessblueprint.com. Let us know that was you and we will get your consulting session scheduled.

Allissa Haines:

Yay. So, hey, I'll go next.

Michael Reynolds:

Yeah, go for it.

Allissa Haines:

I in the What have we been reading situation. I've actually been listening. YNAB, the You Need A Budget budgeting software that Michael and I both adore, that I introduced him to by the way I was using it first. They have a new-

Michael Reynolds:

You had to put that in there, didn't you?

Allissa Haines:

I do, I do. Listen, okay, my only superpower people is that I am a connector. I am exceptionally good at connecting people and things. So, like I connected Michael to this financial podcaster, [inaudible 00:03:45], who has a really huge podcast and he's guested on there a couple times. And I've introduced people to the editors at ABMP Magazine and pardon me, Massage & Bodywork Magazine from ABMP and they've become really well regarded feature writers. I've connected little, less, not so big famous thingies to build cool course. I am a connector, darn it.

Michael Reynolds:

You are.

Allissa Haines:

So when I connect someone to something and it goes really well I feel very proud and feel the need to tell the world. So, anyhow, YNAB has always had a podcast. YNAB has been really based on personal finance, but they have found that many people are using YNAB for business budgeting as well. And specifically it works really well if you also follow what's called the profit first method of business money management, which is a part of... It's a much more complex way to structure your business money so you're paying yourself first and you're paying your own retirement first and that you are adjusting the operating costs of your business to make it so that you are paying yourself what you want to be earning realistically.

Allissa Haines:

So, anyhow, a lot of us use YNAB for that purpose too. And they started a new business podcast. And this was cool because last year the creator of YNAB, Jesse Mecham, Mecham, I don't know. He actually put out a call and was like, "Hey, I'm thinking of starting a business podcast, people give me feedback." And I emailed him, and I was like, "I love the idea of this. I love when you cover business stuff. I love the idea of an exclusive business podcast. But I do want to tell you that the business money world is so packed with middle aged White dudes telling us what to do. I hope that you add some diversity onto it."

Allissa Haines:

So, anyhow, the YNAB business podcast launched and it's two middle aged White guys giving financial advice. But I have listened to the first episode, and it's really good. And my hope is that they will have a more diverse guest component to it, but it's really good. I like it a lot, and I think you will like it too. You can find it on all the major podcast places. And then in our podcast notes, I have put a link to where they are hosting it online, which is SoundCloud. Anyhow, sorry, that was a longer story than I intended. Michael, what are you reading?

Michael Reynolds:

As a middle aged White guy I hope they take your advice.

Allissa Haines:

We'll see.

Michael Reynolds:

All right. So, I am listening to, recently I listened to an episode of the journal and warning if you only listen to this, if you want to feel hopeless and depressed about the state of things in the world. So there's your warning. It's called Why A Grand Plan To Vaccinate The World Unraveled. And it was a catchy title and interesting, so I listened to it. And it was basically all about, I mean, it's just this depressing story about basically, early last year there were plans to create this equitable distribution of the vaccine globally from an organization called COVAX. And the plan was that it was going to equitably distribute the vaccine to countries around the world, regardless of their wealth or other factors. So, basically, a way to make sure everyone gets access to the vaccine. Sounds great, right?

Michael Reynolds:

It also then goes on to talk about, well, the idea was great until the US started buying up all the vaccines, and we bought five times more than we needed. And just did an end run around this whole idea, which caused other countries to start to panic and buy up their vaccines. And of course, I'm sure you know how the story ends, all the wealthy countries bought up all the vaccines, and now the poor countries in the world can't get it. So, it was just a fascinating and depressing story about how the previous administration just screwed the world basically when it comes to vaccines. So that's why I've been listening to. Sorry, it's not uplifting or hopeful or helpful. But that's what I've been listening to and it was fascinating in a negative way.

Allissa Haines:

Thanks for that happy update.

Michael Reynolds:

So, yeah, I was probably muted or just either just dumbfounded.

Allissa Haines:

Wait, can you not hear me?

Michael Reynolds:

Now I can. Yes.

Allissa Haines:

Okay. Sorry. Yeah, that was happy news, thanks.

Michael Reynolds:

You're welcome.

Allissa Haines:

Who's our first sponsor, Michael?

Michael Reynolds:

All right. Let's talk about something positive, which is how great you will feel when you're working with Acuity.

Allissa Haines:

You will because from the moments clients book with you Acuity is there to automatically send booking confirmations with your branding and messaging, deliver text reminders, if you choose. Let clients reschedule on their own while processing payments so you can have your days running smoother even as business gets busier. I am experiencing this myself. And yeah, you should totally check out Acuity, which is the scheduling assistant that just makes your life so much easier.

Allissa Haines:

And actually when this podcast airs on Friday morning, Friday afternoon, I'm doing an Instagram Live with Acuity and I forgot exactly what we're talking about, but we're talking about something. So, if you are listening to this podcast go to Acuity's Instagram and you will see the recording of me doing the Instagram Live with them.

Michael Reynolds:

Well, that sounds like fun.

Allissa Haines:

I think it'll be good and you my friends can get a special 45 day free offer when you sign up today at massagebusinessblueprint.com/acuity.

Michael Reynolds:

All right, thanks Acuity.

Allissa Haines:

So, I got to flip my pages here. Michael, talk to me about today's topic. What do you got?

Michael Reynolds:

All right. We're talking about budgeting with irregular income, which is pretty much every massage therapist because we have irregular income. We have client load that changes week to week and that leads to what I call bumpy or the irregular cash flow of money coming in. So, as Allissa and I are both very experienced with this because we've always I think operated on irregular income as business owners and we're really familiar with this. It's something people struggle with a lot when their income is not the typical W2 consistent paycheck. So I'm going to talk through my suggestions on what I do for irregular income. And this is very common to a lot of... The common wisdom is fairly consistent here with irregular income. So we're going to talk walk through how to manage it.

Michael Reynolds:

Now just a caveat, this is targeted toward budgeting on a personal level. So as Alissa mentioned actually earlier in the episode, a lot of people do use budgeting software like YNAB for business. So I will say that these principles can be conceptually applied to business. But I'm starting from the standpoint of budgeting personally. And there are reasons for that. And one reason is I like to make sure that a personal budget is well defined and separated from a business budget because business and personal are separate entities, I like to make sure people think of them as separate entities, and you're paying yourself properly by pulling money over from your business account to your personal account. So we're going to start with personal budget. And then you can always expand on that. We may expand on that later in episodes further down the road.

Michael Reynolds:

So, let's talk about budgeting with irregular income. First of all, budgeting, I like to start off saying, "Hey, don't be scared of budgeting." It's not a dirty word. Well, as soon as you say the word budgeting, people sometimes get really stressed out, and I get that. It's not a fun word. It conjures up images of restrictions and giving up your Starbucks and just living in this very restrictive kind of environment where you can't have any fun. I get it. Budgeting has negative connotation.

Allissa Haines:

I really like to think about it as prioritizing your expenditures. Or making sure your money is spent where you really want it to be spent. And then it makes me feel like I'm in control of my money versus my life is being dictated by some really sparse budget plan that makes me feel poor all the time.

Michael Reynolds:

Yeah, yeah. And also, I have a deal, by the way on this episode, that I sometimes get a little too technical in the weeds. And sometimes and Allissa has very kindly offered to come in with a perspective that maybe make things more clear and more accessible. So, that's the deal we have going on here.

Allissa Haines:

So pretty much like we do all the time.

Michael Reynolds:

Yeah, that too. Yeah, that too. So, yeah, I think budgeting is very empowering. I think it is like Allissa prioritizing your priority. That's redundant. Prioritizing what's important to you. And there's a lot of myths out there when it comes to budgeting. A lot of people say, "Well, it's impossible to budget with variable income. It's very difficult." Yeah, it's a challenge, but it's not impossible. Some people say, "Well, I'll just make enough money, I don't need to worry about it." That usually doesn't work out either. Or budgeting is so boring. Yeah, I get that. I think budgeting is fun, but I'm a little weird. But it doesn't have to be boring. If you think about it with a certain perspective, you can really start to see budgeting as interesting and fun and empowering. Some people say, "Well, budgeting is too time consuming." It can be, but... Yeah, go ahead.

Allissa Haines:

I got really philosophical. You know how we have all those episodes about productivity and how when you have one secure system for noting all of the things and the ideas and the tasks, it takes a load off of your brain. That's what planning your money expenditures, that's what controlling your finances, so they don't control you does for me. When I sit down and I organize my money and where it's going to go for the next week it takes all of that money stress out of my brain. And it has been hugely stress-wise and anxiety-wise freeing for me. And you'll notice that I purposely avoid the word budget. I try to not use the word budget too much because people internally flinch at that, but use whatever words work for you. But actually sitting down and getting on board with that, what used to be considered evil budget has freed my mind the same way that having a good task and note taking system has freed my mind. So, anyhow, I've got so gesticulated just then I threw my pen across my office.

Michael Reynolds:

I heard it. I heard a crash.

Allissa Haines:

Sorry about that and carry on, Michael, I don't want to keep interrupting you.

Michael Reynolds:

No, no, please do keep interrupting me because it's useful. So, maybe say money plan, whatever you want to call it. And some people say, "Well, I can do a budget in my head, I don't really need to worry about a tool or writing it down or something." Well, that doesn't work either. We know that. The more you keep in your head, the more stuff just gets lost. It stresses you out. Some people say, "Well, budgeting means I'll have to give up my Starbucks or give up X, Y, Z or whatever that thing is." And all these things are really myths. They aren't really necessarily true. We're going to see that I think pretty shortly here.

Michael Reynolds:

So budgeting helps you understand your cash flow. As Allissa said, it lowers your stress, empowers you to make better decisions, and it really gives you freedom. It really gives you more options and more choices. So let's talk about, first of all, the tools that might be useful for you. So, we generally don't come down super strong and like, "You have to use this tool or that tool." And that's by design. I want to make sure that people know there's different choices and what's right for one person may not be right for someone else.

Michael Reynolds:

So with that being said, I want to say there are many multiple budgeting tools you can use. One is Mint. There's Excel. There's a spreadsheet, some people just like spreadsheets, there's plenty of other things. The one that Allissa and I swear by and we'll put a stake in the ground on is YNAB. YNAB is especially good for people with irregular income. And the reason is because other budgeting tools like Mint, for example, they're designed in such a way to say, "Hey, predict how much money you're going to make at the beginning of the month, and then divvy it all out. And you predict the way the month is going to go." And that's really okay for people that get a a standard employee paycheck that's the same every month. That works fine, for the most part.

Michael Reynolds:

YNAB is set up in such a way that lets you take chunks of money as they come in, and then divvy it out and give them jobs to do. The next chunk of money that comes in, divvy those out and give them jobs to do, the next chunk of money and so on. So it helps you really forecast for the future and go with the flow in a fluid manner when chunks of money come in because that's how we operate. Some people, we pay ourselves weekly, or maybe a percentage sporadically, or we pay ourselves every two weeks or monthly. There's so many different variations of how massage therapists will take compensation. And sometimes it's variable. It's, hey, I've got money in the bank. I'm going to take some now. Maybe next week, I'm not going to take any. We do recommend consistency, but it's tough. It's very irregular.

Michael Reynolds:

And so, YNAB is great at this and YNAB stands for You Need A Budget. But if you google YNAB you will find it. And there's a huge community around it, and it's great for this because it says, "Okay, let's, let's see chunks of money coming in. And when a chunk of money comes in, we're going to give it all a job to do and divvy it out." It helps you get ahead of your money. So, I cannot stress enough how YNAB is really, really well designed for volatile, irregular income of a massage therapist. So, we recommend trying it out. You can do a 34 day trial to see how it works, links up to your personal bank account, and I think you'll like it. There's a whole thing we could do on YNAB, which we're not going to do today. But come to office hours if you remember.

Michael Reynolds:

So, next, let's say you've got your tool set up and you're ready to consider your budget here. The main thing you want to have established to really make this all work is a really good strong short term savings. So a short term savings is a buffer. It is a chunk of money in a personal savings account that's separate from your checking account. And it is designed to cover things that are unexpected or irregular income, low points, big purchases, sometimes it's your emergency fund. So the short term savings really, I like to shoot for six months of expenses. I mean, it's variable depending on your situation. But six months of expenses is a pretty good number to shoot for. And then anything additional on top of that is for things like bigger purchases or supplementing cash flow. So part of it's going to be your emergency fund. And part of is going to be spendable income that you're labeling for supplementing cash flow. So, that's your buffer.

Michael Reynolds:

We're going to talk about how that works, but that's your buffer for low months and irregular income. And you want to keep replenishing this. So let's say you're using it for a month where you've got a lower income, and you need to supplement it, you're going to borrow some from that short term savings. You're going to pull it over into your checking account and use that to go into your budget. And then later, when you have higher income, and maybe you got a surplus, you're going to prioritize replenishing that so you always try to keep it well funded.

Michael Reynolds:

So, when you're budgeting, you want to set a baseline minimum. So you want to look at the last three, six, maybe 12 months of income. And by income, I mean money that's coming from your business account into your personal account. Money that you are paying yourself. This is your income that you're looking at. And you want to see what your baseline is. So, if you've been in business a long time, you could look at years maybe, or at least the last 12 months. If you're maybe newer in your business or your tracking doesn't let you see very far back, then do the best you can. Look at three months, six months, 12 months if you can, longer if you can, and see what the trend is.

Michael Reynolds:

You're going to use this to determine what your "base salary" is. I'm putting "base salary" in quotes because we don't think of ourselves as having a salary because we're self employed. But it really is a salary. If you were getting a W2 paycheck this would be your salary. So, your salary is what you are transferring from your business account to your personal account. So, look at those months, determine what your base salary is. And what I like to do is to say, "Okay, look at the high months and the low months and get an average and go a little bit lower than that." I say that because let's say you have, I don't know, a few months of really high income or high income coming from your business, and then the rest of the year is lower, your average is going to be a little bit lower. But you're seeing a trend that the higher months are more of an exception. And so, I think it makes sense to go a little bit lower to be conservative if you feel appropriate.

Michael Reynolds:

So, try to determine your base salary based on that. So say, what can I generally expect? And then you're going to budget based on that figure. You're going to determine, okay, I'm going to build my budget based on the expectation of getting X amount per month, which is my lowest to average base salary, baseline number. So, you're going to create categories based on that budget. Then after you do that, you're going to create categories for additional income when you have higher months. So, when you reach that minimum, and you have excess beyond that, you're going to save that bonus income into those additional categories. And we'll talk about what examples those might be in just a minute. How am I doing so far, Allissa? Is this clear so far, or am I getting too far in the weeds? [crosstalk 00:21:00].

Allissa Haines:

No, I think it's good. I think it's pretty clear. I'm going to note that one of the things. No, this is pretty much how I budget, everybody, this is how I pay myself. I don't have... I have separate accounts for certain things. But I actually, I keep that buffer, that short term savings buffer, I actually keep it in the same account, but YNAB allows you to divide your money into buckets or envelopes. And that's the beauty of YNAB. So, I was really struggling when I tried to have that in a separate account because I wasn't making the transfers regularly enough, and it was just a crap show. So by using YNAB, this is something that has actually helped me do is... I certainly have separate accounts for certain things, but not for this because I found it works better for you. So, you have to play with this. You have to not have success with one method to figure out what exactly the best method is for you.

Allissa Haines:

When I was first figuring out the salary I was going to pay myself, I did what you said, Michael. I looked at the high weeks and months, and I looked at the low weeks and months. I actually have to do this stuff weekly because monthly is too big a picture for me. So, I actually went weekly through the last 52 weeks or something. And I looked at my lowest handful of weeks, and I went by them, and I didn't even average, and then go low, I just went by my lowest weeks. And I did that for a couple... I paid myself that low amount for a couple of months. And then felt really good about giving myself a raise. So, I was able to give myself a raise every three months or so just working up to what was a more rational average salary.

Allissa Haines:

Again, you figure out how to adjust these things. I say start really strict, and it's not really even very strict. But start with the really solid method that Michael lays out, and then figure out where your strengths and weaknesses are and keep it evolving. Because none of this is static. None of this is a system that you're going to stick with exactly as you start for the next 20 years of your career. It's always dynamic, and it's always evolving to suit your needs, to serve you best.

Michael Reynolds:

Yeah, great point. That's a great segue also into the banking structure discussion, which is different for everybody. So I'll tell you what I do. And some people love this, some people don't. So, Allissa is very high discipline. So, a high discipline person will say, "Hey, I don't need multiple bank accounts. I'm just going to use YNAB and categorize it," and that works really well. Some of us are lower discipline, and we need a little more life hacks in place to give us some guardrails. And I'm not necessarily saying I'm high or low discipline, I just happen to like the structure. But what I do is I have separate bank accounts for things.

Michael Reynolds:

I'm not spending too much time on this because I know it's too much complexity for some, but I have you've got your business account, which then you pull money over to your personal account, and we're budgeting from your personal checking which we've established. So then I have a separate short term savings account at a different bank. I've got a personal tax account, also at a different bank. And then I have a travel and vacation account at a different bank still. And to me, I like that because that creates clear barriers between buckets of money that are designed for specific things. So, to me, the transfer is easy, I go online to do the transfer. Actually, some of it is auto recurring automatically. I don't even touch it.

Michael Reynolds:

So, if you're not really big on a bunch of separate accounts, totally fine. I do maintain though, that having a separate short term savings separate from your checking can have value for a lot of people because I know a lot of people that I work with that they're very prone to just going to grab money from the account if it's at the same bank because within seconds you can do a transfer on line between accounts at the same bank. So they just grab it, they just pull it over. And before they know that they've drained their short term savings because it's so easy and low friction.

Allissa Haines:

So can I say what I do?

Michael Reynolds:

Yeah.

Allissa Haines:

So, my system again is inspired by a system similar to Michael's but I figured out again my strengths and weaknesses. So, I have my business checking and a business savings at my local credit union. And I found that I don't actually need a separate savings account for storing money from gift certificates and packages. I can store it in my regular checking account. Because YNAB allows me to put it in a bucket. Before that I had to have it in a separate savings, or I would accidentally spend that money. And I have a business savings, which is just a couple months of business operating expenses, which frankly saved my butt last year when we had to shut down. So, that's my business setup.

Allissa Haines:

And then I have a personal setup at another bank, at Ally, an online bank. And I have a personal checking, and I have two savings accounts. One of them is for my taxes because I will absolutely rob my tax account and then be short on my quarterlies. And then owe at the end of the year. I have found that. So, I pay myself weekly. And then I immediately put a certain percentage of that. I move it out of my personal checking into my personal savings. And then I have a second personal savings that is my larger emergency fund with hopefully not quite there yet, but three to six months of living expenses, which again, like I had last year, thank goodness. And I found that that's all I need. I don't need separate banks for those savings. But it's ridiculous because I will rob myself with if I need something or my car breaks down or whatever.

Allissa Haines:

I will rob my tax savings before I'll rob my new car savings, which was stupid because in my head taxes are always so far away, which is insane because I am the person who for two different years ended up owing a crap ton of money and had to get on payment plans with the IRS. So, it's weird to me that I still have that tendency to borrow from my tax money. But as long as it's in a separate savings, and I don't even keep that savings. It's not in my budgeting software. I don't even see it. I never know how much is there. Except that I know enough is there because I have put it in some every week. So, we all have to work with our different tendencies. I won't move stuff between accounts to steal from it. But I absolutely if I keep my tax money in my primary checking, I will absolutely rob it. I don't know what is wrong with me, but that's how it works for me.

Michael Reynolds:

Yes, so do what works for you. So, if you're interested in learning more about the whys and the reasons behind multiple banks, I'm happy to talk about it. But I'll just leave it as just to say, consider multiple accounts or multiple buckets for money, if that helps you categorize and prioritize. So when you're prioritizing your spending, you want to first of all, if you're using YNAB, YNAB has categories already set up for this stuff really well. I stick with the defaults. I know Allissa you customize yours a lot. A lot of people customize theirs. I like simplicity. So especially if I'm training someone using YNAB I'm like, "Hey, just leave the defaults there for now. Go with the flow, and you can always adapt it later."

Michael Reynolds:

YNAB sets things up in big broad groupings called immediate obligations, debt payments, true expenses, quality of life, and just for fun, and I tend to just go with those. So, your immediate obligations are at the top. These are things like I put taxes there. I put paying into your tax account to get ready for quarterly estimates. I put that actually number one because we don't want to get in trouble with that. Mortgage and rent, utilities, internet, groceries, transportation, your car loan. Things that are if those things don't get paid, you've got problems. That's the kind of stuff that goes under immediate obligation. So, that's at the top of your budget. You want to make sure at the bare minimum, that stuff is covered with your minimum baseline salary. Ideally, it is. If it's not, then you've got other stuff to work through and figure out, but let's assume that's the case.

Michael Reynolds:

Then after that I prioritize a grouping called debt payments. Just because you want to stay current typically on debt. You don't want to damage your credit score, or get behind on things. So things like credit card payments, maybe student loan, other debts, medical debt, stuff like that. Make sure those things are kept current. True expenses would be next as well. Now, it depends, you might swap true expenses and debt payments depending on your situation. Some would argue those true expenses are more important than they might be. So just think of that as potentially interchangeable. But these are things like household items, pharmacy stuff, medical payments, miscellaneous stuff for the home and for clothes. Things that you need that are not frivolous, but they are not necessarily mission critical. If you don't get around to them for a month because you're a little short, your household not going to shut down. So, that's the next category or sub grouping.

Michael Reynolds:

And then after that, you've got things like quality of life and fun stuff. So quality of life would be things like saving into your short term savings to build out a pyre. Saving in your Roth IRA. Maybe saving in your solo 401(k) or whatever retirement plan you have set up, putting money in your travel and vacation account. Stuff that is important for long term quality of life stuff. But if you have to skip a month or two life goes on. And then just for fun is also a category that is for surplus stuff. Eating out, fun stuff, entertainment. And again, these are not meant to be judgmental. So some might say, "Well, I..." Some people would put fitness and yoga under just for fun, but I think it's quality of life, or I think it's immediate obligation because it's for mental health, that's fine, that's you. Do what works for you. Don't let someone else impose their budget categories on you just because it's set up a certain way.

Michael Reynolds:

I personally set things up a certain way. But there's a lot of wiggle room on what's important to you. So, some people might say that certain categories are more just for fun. Other people might say they are quality of life, or true expenses, or things that are more important because they're important to them. So, that's okay. Make this your own. But conceptually, this is how I would recommend categorizing your priorities. So, immediate stuff, debt payments, and true expenses are next. Ideally, those categories are where you're covered with your baseline salary. Maybe more, maybe you also can contribute to your retirement account with your baseline salary, and that would be great. And then whatever surplus you've got, you roll down your budget and start filling in the rest as well. Does that make sense so far?

Allissa Haines:

It does make sense. And sorry, I was delayed because I was actually looking at my personal YNAB, and I was screenshotting how I categorize stuff while you were talking about yours. I'll have it shared in the podcast notes.

Michael Reynolds:

Nice, cool. I've got a couple screenshots, too. We can mix and match and give them options there. And then, okay, so you've got your budget established. You're budgeting with your baseline salary number. You are then using any surplus beyond that in a good month to roll down and fill up the rest those categories and budget based on that. So let's say you've got a low month. Okay, so now we're going to get to how we use that short term savings buffer. So during average months, you're maintaining, you're going with the flow, and doing what you need to maintain the household, and fill in what you can. Then let's say that you got a high month. Again, I said you fill up your quality of life and other categories during those high months.

Michael Reynolds:

During your low months, you supplement your cash flow from your short term savings buffer. So this is assuming the low months are not so frequent that you drain your short term savings. If they are then you got to go back and reevaluate your baseline salary. But everyone has these low months where you've got less income coming in than you would have expected, normally. These are your you're lower than your baseline. So then you pull from your short term savings, transfer that into your checking account. It shows up as inflow in your budgeting tool, which we're going to go with YNAB here, and then you've got that cash flow to supplement and bring it back up to the baseline. And then you can maintain your household.

Michael Reynolds:

Then at your next high month, you go back and replenish that short term savings as much as possible, so you bring it back to a point where you want it to be. So, this is a way of making sure that you don't really ever go below that baseline. So you have an expectation of consistent income. And I want to say as a side note, this is really useful if you are in a mixed household where one of you is entrepreneur, one of you is more of a W2 employee. And this comes up a lot because Allissa and I have talked about this before, I think in the past. It's really tough when you're with a partner in a household that does not really get what it means to be a business owner. And they're like, "Hey, why aren't you making as much money as last month and what's going on? What's going on with your business?"

Michael Reynolds:

They don't quite get that this is how it goes. When you're self employed, it's hard to predict some of this stuff, and you've got ups and downs, and you've got stuff that just comes up and you got to deal with and money isn't always consistent while they're getting a steady paycheck and they don't really understand. So this can really help bring the household together sometimes to say, "Hey, okay, we can establish some consistency so you're not stressing everyone out." So, this can be really useful in that situation.

Allissa Haines:

Do you know what? I'm so removed from it that I totally forget that there are families and couples that merge all their money.

Michael Reynolds:

Yeah, it happens.

Allissa Haines:

I am so the other end of that, and I never. I don't really discuss my business finances all that much. Now, I didn't when I was starting my business and I was married, and I don't now with my partner other than this is what I'm putting into the household fund this month, though. This is what I'm paying for. I forget that. So thank you for having a polar opposite experience with that, that you shared. If anyone wants to talk about how to keep the bulk of your finances separate except for one little household fund, give me a call. I love it.

Michael Reynolds:

Yes, so whatever applies to you, go with that. So, I want to also go on a side tangent here briefly as well to say that you're probably noticing that this system is assuming that you're paying yourself with some consistency. And I want to touch on this point because over and over and over, I see that business owners love to keep a bunch of money in their business account and not pay themselves. It just happens all... Allissa and I both see it all the time. You just leave a chunk of money in your business account. You just grab it when you need it. Or maybe even you're mixing your transactions, you're paying for personal stuff out of your business account. And you're thinking, "Oh, it's all the same money." It's really not.

Michael Reynolds:

I really want to encourage you, if you're doing this, to get money out of your business bank account and be consistent about it. You want to be thinking of your business as an asset that is giving you income. There's a couple ways to think about this. One way is this is a job you have that should be paying you. You should be getting paid for the job you do. You're doing massage, you're getting paid for it, and you're getting paid by the business that holds the money. So get it out, pay yourself.

Allissa Haines:

I do to... I'm going to jump in to note that episode 347 is all of the why you should pay yourself and a little bit of how you should pay yourself. So if you're struggling with that, go back to episode 347, and we cover it in detail.

Michael Reynolds:

Yeah, good call. And also, I like to encourage people to think of their business as an asset. An asset like your home, something that is worth something, something that has value to you, and it should be giving you an income. Like a retirement account. Let's say you're in retirement and your retirement account should be giving you an income. Your business should be giving you an income. So it's not... I mean, maybe for some people it is, and if so that's great. Own that and know it, but this should not be a passion project labor of love that sucks your soul away. This is a business. It should be giving you money. It should be producing money for you. So get in that mindset of my money gives me income. That's what you want to get the mindset of, and I think that will help you get money out and into your personal account so that you feel like you're making money from your business.

Allissa Haines:

So I have a question.

Michael Reynolds:

Yeah.

Allissa Haines:

Here we go with financial counseling for everyone to hear. So, what I do, I mean, I pay myself, I pay my expenses. And I have a buffer there that is exactly the amount of packages and gift certificates that are unredeemed because I pay myself for those as I go. And then I have that separate savings account, which is three months operating expenses. Is that reasonable or should I not? What do you think?

Michael Reynolds:

You're talking business account?

Allissa Haines:

Yeah.

Michael Reynolds:

Yeah, this actually came up, someone else asked me this recently. And I think it depends on your business. So, obviously, we're all talking about massage business, I'll come back to this. But let's say you are a software company, for example. I'm going to illustrate this contrast. A software company where you've got recurring monthly revenue, that's super consistent. You've got a really lean team, really low expenses. You don't really need much in the bank because your income is so pseudo guaranteed, so consistent, volatility is so incredibly low, overhead is so low, that you probably don't need more than a month if that. But if you're a service business like us, a massage therapy practice, you're going to want probably two to three months, just like you said. I think is what he said. That is reasonable, I think, because volatility means that you're going to want more of a buffer. So it depends on your type of business. So in our business I do like a couple months if possible, if not more to make sure that you've got that buffering your business.

Allissa Haines:

Sweet. I tend to have a little bit more of that buffer because I within YNAB I'm saving for certain things. So, I'm saving for a very expensive lymphatic drainage class. So I got a couple extra grand sitting there right now that's earmarked. It's in the bucket for education. I think I've been... I heard you say this at some point a while back, and I thought that's true. I'm so nervous about having enough business money and paying my expenses that I'm keeping too much money when I should be paying myself.

Allissa Haines:

I have to say that this last year of the times that I collected the pandemic unemployment assistance, and then when I was paying myself with the PPP. I was getting paid weekly, which is not a thing I had typically done. I'd usually paid myself every other week or once a month. And I really learned through this experience that getting paid once a week is better for me. It's better for my personal budget, and it's better for me mentally to see and feel the financial benefits of my hard work. So if you have put it off, or if you're like paying yourself monthly, and you've struggled with that try every other week or if you do every other week, and it's not working for you try weekly.

Michael Reynolds:

Yeah. And also, by the way, I mean, you're getting taxed on the money anyway, so at some point get it out because you're going to be taxed on it. So, I'm guessing that every one of our listeners is probably either a sole proprietorship, LLC, maybe an S-corp, I would venture to say that's everyone, which means you're what's called a pass through entity, which means that you get taxed on whatever your business makes. Whether it's sitting in the business bank account or your personal bank account. So you're getting taxed on it anyway, you may as well take it home. So pay yourself.

Michael Reynolds:

All right. Hey, that was a long episode, but I think we're done here. Let's wrap up. So I want to say keys to success here. Let's remember, let's recap. Stay on top of it. Budgeting is hard at first, but don't give up too early, start, get a rhythm going, get used to it. It takes about two or three months to really get going and use mobile apps. I know unless you like the website better. I like the mobile app better I use both. But a lot of people, they will never log into the website because they just don't do it. But they'll have the app on their phone. And they can pull it up every couple days and do quick categorization and stay on top of it. So if you're someone that's just not going to log into a website, make sure you've got the mobile app on your phone. So you can quickly categorize while you're just getting some downtime. And that helps you stay on top of it.

Michael Reynolds:

Don't let little glitches get in your way or don't let perfection get in the way. You're going to stumble and have some learning experiences along the way. But budgeting is truly worth it if you stick with this, so don't let little glitches stop you. And be sure you interface with your budget every few days. This sounds like a lot. But what I see is that when I'm helping people with YNAB the biggest issue I see over and over is they will get the budget set up, get all excited, great I'm budgeting, and then they'll let two weeks go by without logging in. And then when we meet again in a couple of weeks, we review their budget, and they have 200 transactions to categorize. And it's like, "Oh, this is overwhelming, I'm done." Because it's just overwhelming.

Michael Reynolds:

So don't let your transactions that are flowing in, don't let them build up so much. Just open your app every couple days, categorize the five or 10 things that are there, it takes literally one minute, and you're done. And if you stay up to date with it, then it becomes super easy and low stress and easy to maintain because you're not letting it build up. Be sure you pay your quarterly tax payments. I always like to slip this in any chance I get. Because it's such a thing that trips people up as well. Pay those quarterly tax payments. If it takes a separate account for you to keep it hands off. If you use YNAB to categorize it, whatever it takes. Be sure you're setting aside personal money from your income to pay those quarterly tax payments. That gets a lot of people in trouble. So, budgeting will help you identify that and work with that as well. So, that's my shtick. I want to hear what Allissa has to say as well. But that's my spiel.

Allissa Haines:

I think it's a good spiel. I was thinking about this. What I really think is if any part of this was confusing to you or you need clarification, you should email us at podcast@massagebusinessblueprint.com. Email us your question, and when we get five or 10 questions, we will do another episode that's very specifically answers your Q&As. Because clearly, we could talk about this all day. This is probably Michael and I's favorite thing to talk about is money management. And we are going to nerd out on it as often as you need us to and as specifically as you need us to guided by your questions. That what I'm going to say.

Michael Reynolds:

Yeah, thank you, I will say this. I'll make it just a strong sales pitch right off the bat here for our office hours. So if you're not a member of our community, consider joining. This is the kind of stuff we help people with on office hours. So we have office hours scattered throughout each month. Allissa and I both do them. And if you want to figure out how to do this, how to set this up, you can come to office hours, and we will help you. You can come to multiple office hours until you get it and we'll help you over and over and over. So that's what we do in our community. So consider joining if you're not a member. [crosstalk 00:43:42].

Allissa Haines:

You know what I'm think of doing? So, on top of our office hours, I run something a couple times a week usually called the Power Hour where we all log into a Zoom and at the beginning of the hour we say the little business task or whatever that we're going to accomplish. And then in the last five minutes of the hour, we all report back. So, it's kind of like we're virtually coworking around a big table at a coffee shop. And we don't really talk to each other all that much or anything, really at all. We mute and do our task and report back. And it's really nice. It's taken away some of the loneliness of working from home and stuff.

Allissa Haines:

I am actually going to start doing very specific money management power hours where everybody works on their money task and I will be available to answer little questions, technical questions that come up throughout that hour. So, I'm really excited to start doing that. It's on my to-do-list.

Michael Reynolds:

Yeah, people love those.

Allissa Haines:

All right, who's our final sponsor?

Michael Reynolds:

Our friends at ABMP.

Allissa Haines:

Thanks, ABMP. They say they're proud to sponsor our podcast, and we believe them.

Michael Reynolds:

I believe them.

Allissa Haines:

I believe them. One of the many, many benefits from ABMP membership is the Massage & Bodywork Magazine. This award winning magazine is included in print for ABMP members. I'll tell you right now it is the only magazine that I keep paper copies of and they're all sitting right here on my shelf. I can look at them. I got like four years worth and I reference them frequently. Okay, even if you're not a member, which is crazy, but whatever. Even if you're not a member, you can read the magazine for free at massageandbodyworkdigital.com. Frankly, our business, our blueprint for success column is quite good in the business practices section. Their regular columnist are fantastic.

Allissa Haines:

My personal favorite is Ruth Warner's pathology column. It is a professional journal, it is the professional journal. That includes hands on techniques, in depth features about every aspect of our profession. And it's got video tie-ins, which are really fun to cover the issues that matter to professional body workers. You can find all this and more at abmp.com. We love you. Thank you, ABMP.

Michael Reynolds:

Thanks, ABMP. All right, got any quick tips today?

Allissa Haines:

I do. As I am returning to something related to a normal schedule with multiple jobs and such, I realized that there was a thing that I used to do that I hadn't been doing that was making my life harder. So, I got back to meal prep. It is one of the pre-pandemic things that I had, that was really helpful to me, but because I had been home so much, and I'd been cooking meals. I had the time to cook meals almost every day from scratch for months and months and months, I got out of the habit of batch cooking on Sundays and Wednesdays. And putting portion sized dishes in the fridge for a couple days after that. Things are getting busier. I'm getting more stressed. And I realized I hadn't done it.

Allissa Haines:

So, I went back to doing a weekly... I'm not doing twice a week anymore, but I'm doing a weekly meal prep that is lunches and dinners and snacks of fruit because it's summertime and I love to cut up a melon on a Sunday and eat it all week. And if I pre cut it, I will actually eat the fruit instead of a candy bar. But if I don't pre cut it, then the melon will sit on my counter until it goes bad two weeks later. So, I got back to meal prep. So, if there's something that was helpful to you in your past life, in your pre-pandemic routine, I would encourage you to put that back into your routine.

Michael Reynolds:

Nice. I like it.

Allissa Haines:

What about you?

Michael Reynolds:

My quick tip is simplify and clarify your message. I've been working with a few people, a few massage therapists on niching and things like that recently, and a whole different business doing other stuff, too, to help people work on their business startups as well. And a theme that's been coming up recently is messaging and how to talk to the world about what you do. And I'm noticing it's very tempting for all of us, myself included, to overdo what you're trying to throw at people. Your brain is so full of all the stuff you want to say to people that we often feel like we have to get it all out of our website and all of our marketing materials and just give them all the information, and we end up being somewhat vague sometimes and somewhat overwhelming.

Michael Reynolds:

I would encourage you if you're struggling with how to message your website and marketing materials, try really hard to just simplify and clarify it. One example is I was talking to a member recently. She was talking about niching, and the target market in this case was people with anxiety and depression. And there was a lot of dancing around language and stuff on the website. I was like, "Hey, what's wrong with just saying, massage for people with anxiety and depression? Or I work with people with anxiety and depression?"

Michael Reynolds:

Being super clear and simple often resonates with people really well. A lot better than trying to figure out what you do. So, look at your website this week is my suggestion. And look at it through the eyes of a potential client and see if you can figure out what you do and who you serve if you are that potential client. Look through, look really objectively and critically through all your content. And if you can't consider just being really plain spoken about it and saying, "I work with people who," blank, fill in the blank, who are like this, or I do this for people. And you don't have to use super fancy elaborate language. Just keep it really simple and clear and plain. I think you might have more success in reaching those people that are your target market.

Allissa Haines:

Word man, word. All right if you have something you want us to cover here on this podcast you can email us at podcast@massagebusinessblueprint.com. If you have something nice or not nice. I won't make fun of you I promise if you leave a negative review. You can leave that review on Apple Podcasts and maybe we will choose you for a consult, which will be extra fun if you've left us a bad review. So, I think that that's all I have to say. I don't normally do this part of the episode. So, did I forget anything, Michael?

Michael Reynolds:

I don't think so. I usually give a pitch for our member community. But I've already done that earlier. So, I think we're good.

Allissa Haines:

Yeah, everybody, I hope you have a super lucrative and productive and happy day. Thanks for listening.

Michael Reynolds:

Thanks, everyone.